François Trausch

CEO and CIO PIMCO Prime Real Estate

Raphael Mertens

CSO PIMCO Prime Real Estate

Leadership perspective

A message from the CEO and the CSO

In today’s rapidly evolving climate and regulatory landscape, real estate companies are responding to client mandates by embedding sustainability frameworks that go from foundational upgrades to forward-looking investments in resilience and climate risk management.

At PIMCO Prime Real Estate, we support more than 50 clients with tailored approaches that reflect their specific sustainability goals, considering not only carbon reduction strategies, but also health and well-being.

Our sustainability framework is focused on active local management, enabling our teams to source deals and execute business plans with precision. Our superior track record of implementing portfolio decarbonization strategies globally and across sectors continues to bring value to our clients. We use CRREM (Carbon Risk Real Estate Monitor) as a global benchmark to guide our decarbonization efforts, and our operational expertise has already enabled a 25% CO2 reduction in our clients’ real estate portfolios ahead of schedule. We remain on track to meet even more ambitious targets by investing in energy efficiency, renewable energy, and applying strategic measures that support the transition of one of the world’s largest real estate portfolios toward net zero.

This playbook showcases the areas of expertise that we have developed and explains how we apply them into sustainability-driven actions. It outlines our strategies for evaluating and identifying environmental risks across client portfolios, alongside technologies that we have implemented to futureproof assets and support long-term sustainability. While we make improvements to individual buildings, and in accordance with local regulation, we roll out change on a global scale and develop our approach and enhance our capabilities as our industry evolves.

Our Journey

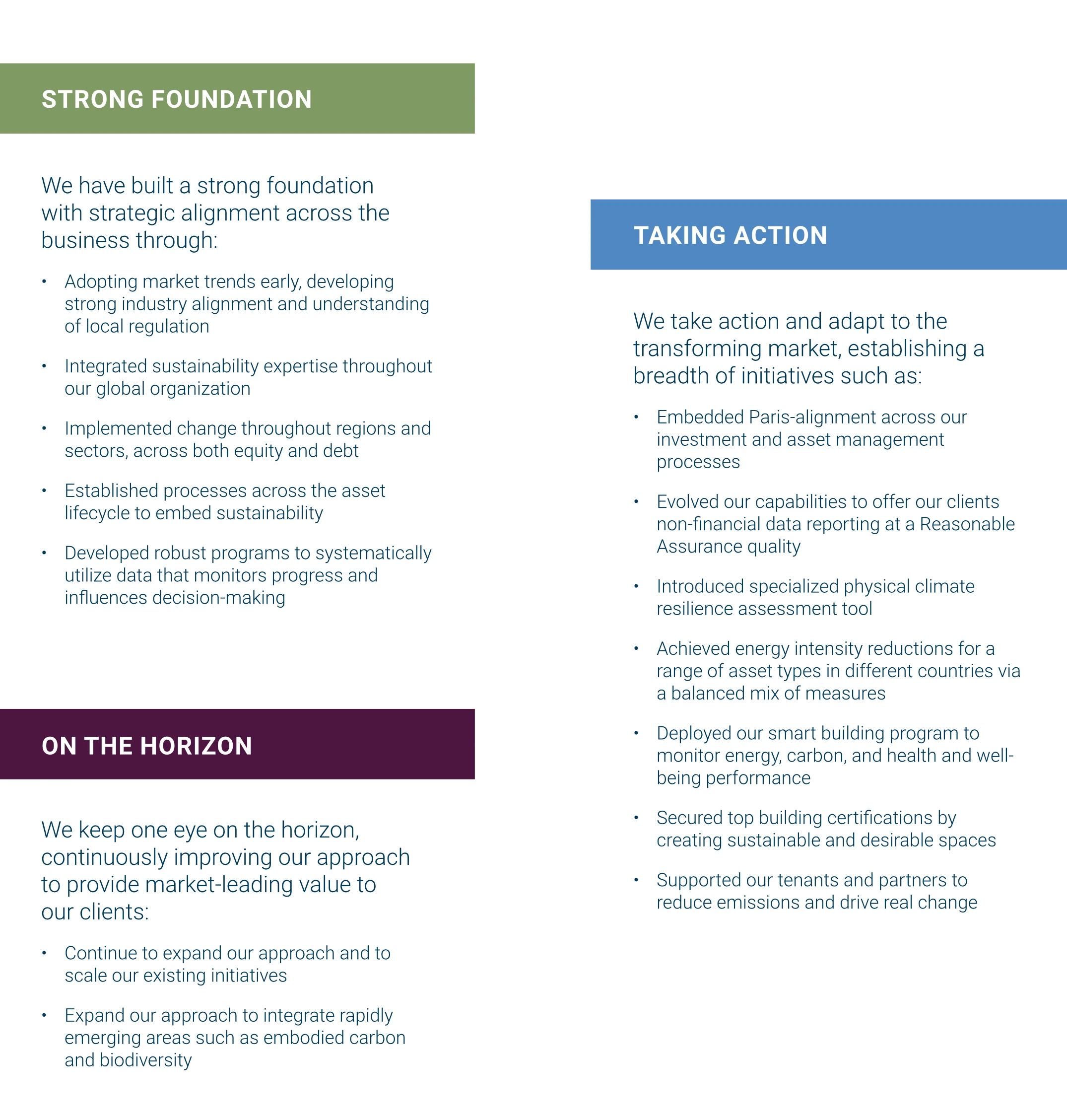

Since 2018, PIMCO Prime has been adapting clients’ real estate portfolios to respond to dynamic market changes. We have invested in building a strong sustainability foundation, prioritizing our people, processes, and systems to enable us to embed sustainability across the asset lifecycle through established global processes. We designed our framework to consider both equity and debt as well as all sectors and regions and developed robust data programs that support every aspect of decision-making. We will continually assess and evolve our approach to provide market-leading value to our clients.

Framing our approach

Drivers

The continuously evolving market landscape is being defined by regulation, occupiers, and investors. These drivers have profound implications for the real estate industry, presenting both risks and opportunities for investors.

Regulation

Increasingly stringent (non-) financial disclosure and building performance standards are having material impacts.

Occupiers

Demand for sustainable buildings is growing rapidly, creating a shortfall in the market.

Investors

Net zero compliance remains top of the agenda for many investors and creates opportunities for those skilled to transition assets.

Our expertise

In this dynamic operating environment, real estate players are evolving their approach by adjusting investment practices and policies. PIMCO Prime began developing the expertise to adapt our clients’ real estate portfolios in 2018 and continually evolves with the ambition to remain a market leader in this area.

To deliver resilient returns, on a product-by-product basis, we prioritize key areas for action which are supported by robust data collection. We focus on carbon and energy performance as well as climate risk adaptation as we see them as the most critical issues from a regulatory and market perspective.

PORTFOLIO MANAGEMENT

• Global approach, local implementation

• Materiality-driven framework

• Consistency at scale

• Monitoring & reporting

INTRINSIC ASSET RESILIENCE

• Energy performance

• Operational and embodied carbon

• Renewable energy

• Climate risk adaptation

SUSTAINABLE MANDATES

• Sustainable investments

• Capacity to align to sustainable regulations, such as Sustainable Finance Disclosure Regulation (SFDR), alongside initiatives as EU Taxonomy

Our delivery model

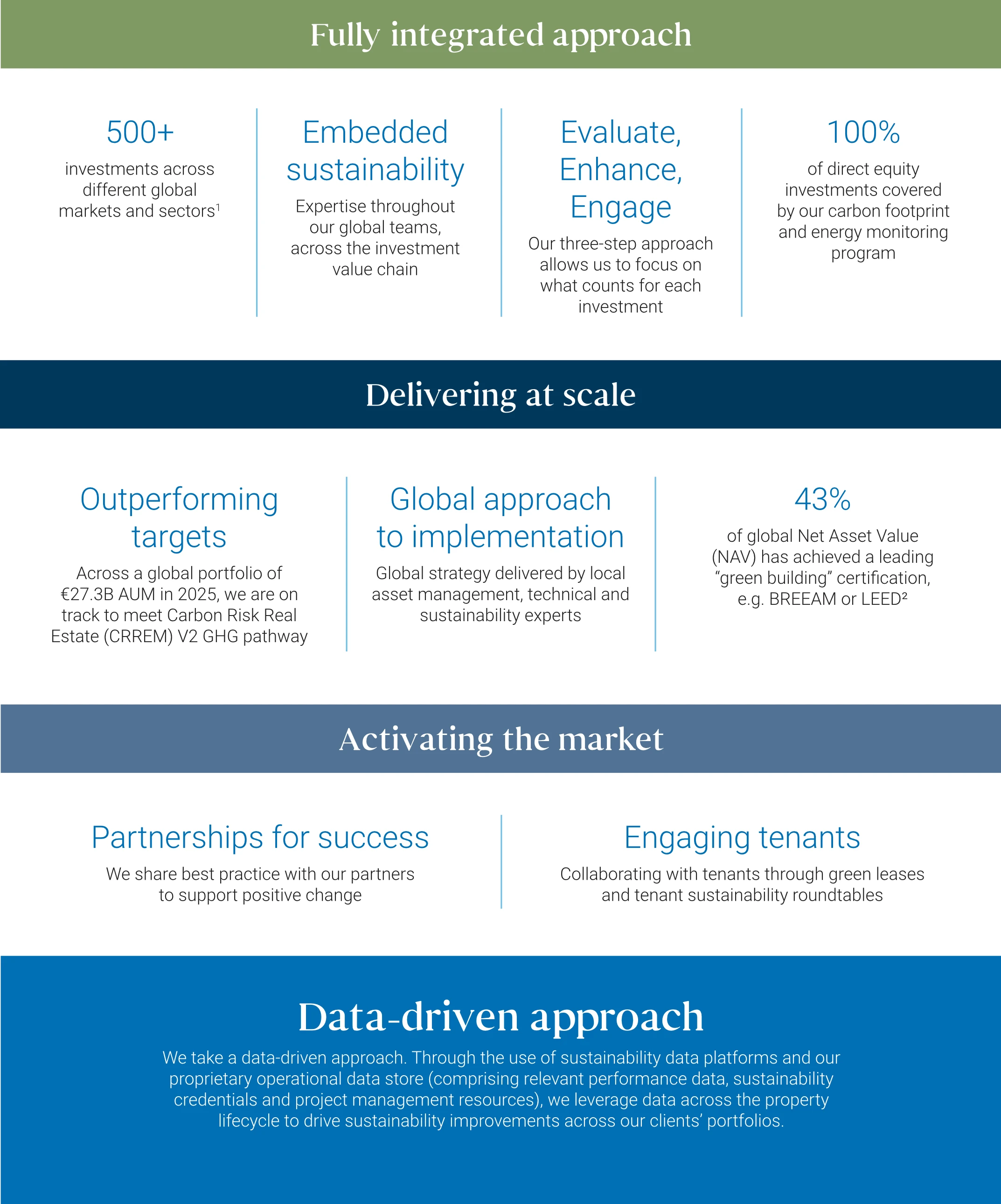

Our integrated, disciplined, and data-driven approach, guided by a proactive and continually evolving philosophy, enables us to deliver at scale. We do this through three important actions: evaluating our assets and partners; enhancing the performance of our portfolio; and engaging with our partners and industry bodies to drive progress in sustainable practices.

EVALUATE

Measuring the sustainability impact of investments, we develop and maintain a comprehensive understanding of intrinsic asset resilience throughout the investment lifecycle.

ENHANCE

Delivering material performance enhancements on a global scale, we use data to shape our decisions.

ENGAGE

Driving positive change throughout portfolios, we proactively engage with our tenants, partners, and industry bodies to educate and influence adoption.

1 As of Q2 2025.

2 Only considering top levels of building certification standards (BREEAM , HQE – “Very Good” or better; LEED, DGNB – “Silver” or better; or other alternative comparable certification).

Disclaimer

The sole purpose of this presentation (“Presentation”) is to provide information on a non-reliance basis. In this Presentation PIMCO Prime Real Estate GmbH and PIMCO Prime Real Estate LLC, their subsidiaries (including PIMCO Prime Real Estate Asia Pacific Pte Ltd, PIMCO Prime Real Estate Japan Gk, PIMCO Prime Real Estate Shanghai Co Ltd), branches and affiliates are jointly referred to as “PIMCO Prime Real Estate”.

The material contained herein is for informational purposes only and does not constitute legal, tax or investment advice. A recipient should consult advisers regarding such matters and must not, therefore, rely on the content of this Presentation when making any decisions. An interested recipient must make their own decisions based on their own investment criteria, research and analysis, risk assessment, due diligence and should consult with professionals and advisers qualified to render such advice before taking any decision.

Any forecast, projection or target where provided is indicative only and not guaranteed in any way. PIMCO Prime Real Estate accepts no liability for any failure to meet such forecast, projection or target. The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Where overseas investments are held, the rate of currency exchange may also cause the value of such investments to fluctuate.

No representation, warranty or undertaking is given by PIMCO Prime Real Estate or any other person in respect of the fairness, adequacy, accuracy or completeness of statements, information or opinions expressed in the Presentation and neither PIMCO Prime Real Estate nor any other person takes responsibility for the consequences of reliance upon any such statement, information or opinion in, or any omissions from, the Presentation. The information contained in this Presentation has not been audited or verified. PIMCO Prime Real Estate may have issued, and may in the future issue, other communications that are inconsistent with, and reach different conclusions from, the information presented herein. Those communications reflect the assumptions, views, and analytical methods of the persons that prepared them. Any views expressed were held at the time of preparation and are subject to change without notice.

The information contained herein is proprietary and confidential and may include commercially sensitive information, must be kept strictly confidential, and may not be copied, used for an improper purpose, reproduced, republished, or posted in whole or in part, in any form, without the prior written consent of PIMCO Prime Real Estate. The recipient of this material must not make any communication regarding the information contained herein, including disclosing that the materials have been provided to such recipient, to any person other than its representatives assisting in considering the information contained herein. Each recipient agrees to the foregoing and to return or destroy the materials promptly upon request.

The distribution of this Presentation in certain jurisdictions may be restricted by law. Persons into whose possession this Presentation comes are required by PIMCO Prime Real Estate to inform themselves about and to observe any such restrictions.

This Presentation should not be construed as research, investment advice, or any investment recommendation. The content of this Presentation is for informational purposes only and might discuss market and investment trends and criteria. Certain information contained herein concerning economic trends and/ or data is based on or derived from information provided by independent third-party sources. PIMCO Prime Real Estate believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

It should not be assumed, and no representation is made, that past investment performance is reflective of future results. Nothing herein should be deemed to be a prediction or projection of future performance. If and to the extent that any statements herein include prospects, statements of future expectations and other forward- looking statements, these are based on the current views and assumptions of the persons that prepared this document, and involve known and unknown risks and uncertainties. No representation is made or assurance given that such views are correct. Actual results, performance or events may differ materially from those expressed or implied in such forward-looking statements. Prospective investors should not rely on these forward-looking statements when making an investment decision.

PIMCO Prime Real Estate expressly disclaims any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in this document, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting therefrom. PIMCO Prime Real Estate assumes no obligation to update any information or forward-looking statement contained herein. This disclaimer notice (and any non- contractual obligations arising out of or in connection with it) is governed by German Law.

PIMCO Prime Real Estate is a PIMCO company. PIMCO Prime Real Estate LLC is a wholly-owned subsidiary of PIMCO LLC, and PIMCO Prime Real Estate GmbH and its affiliates are wholly-owned by PIMCO Europe GmbH. PIMCO Prime Real Estate GmbH operates separately from PIMCO. PIMCO Prime Real Estate is a trademark of PIMCO LLC and PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. ©2025, PIMCO.