BY MEGAN WALTERS, JOHN MURRAY, FRANÇOIS TRAUSCH

- Commercial real estate markets are under acute pressure amid higher interest rates and financing constraints. Prices in the public markets have tumbled, while prices in the private markets have yet to catch up.

- Bank lenders are constrained by limited loan paydowns and intensifying regulatory pressures, while commercial mortgage-backed security (CMBS) lenders remain sidelined amid public market volatility.

- CRE owners face more than $1.3 trillion of loans maturing in the U.S. and Europe over the next two years, while a weakening global economy slows tenant demand.

- This environment will, in our view, provide attractive opportunities for investors with deep expertise and flexible capital to provide liquidity to banks, structure complex solutions for asset owners, and acquire discounted assets from motivated sellers.

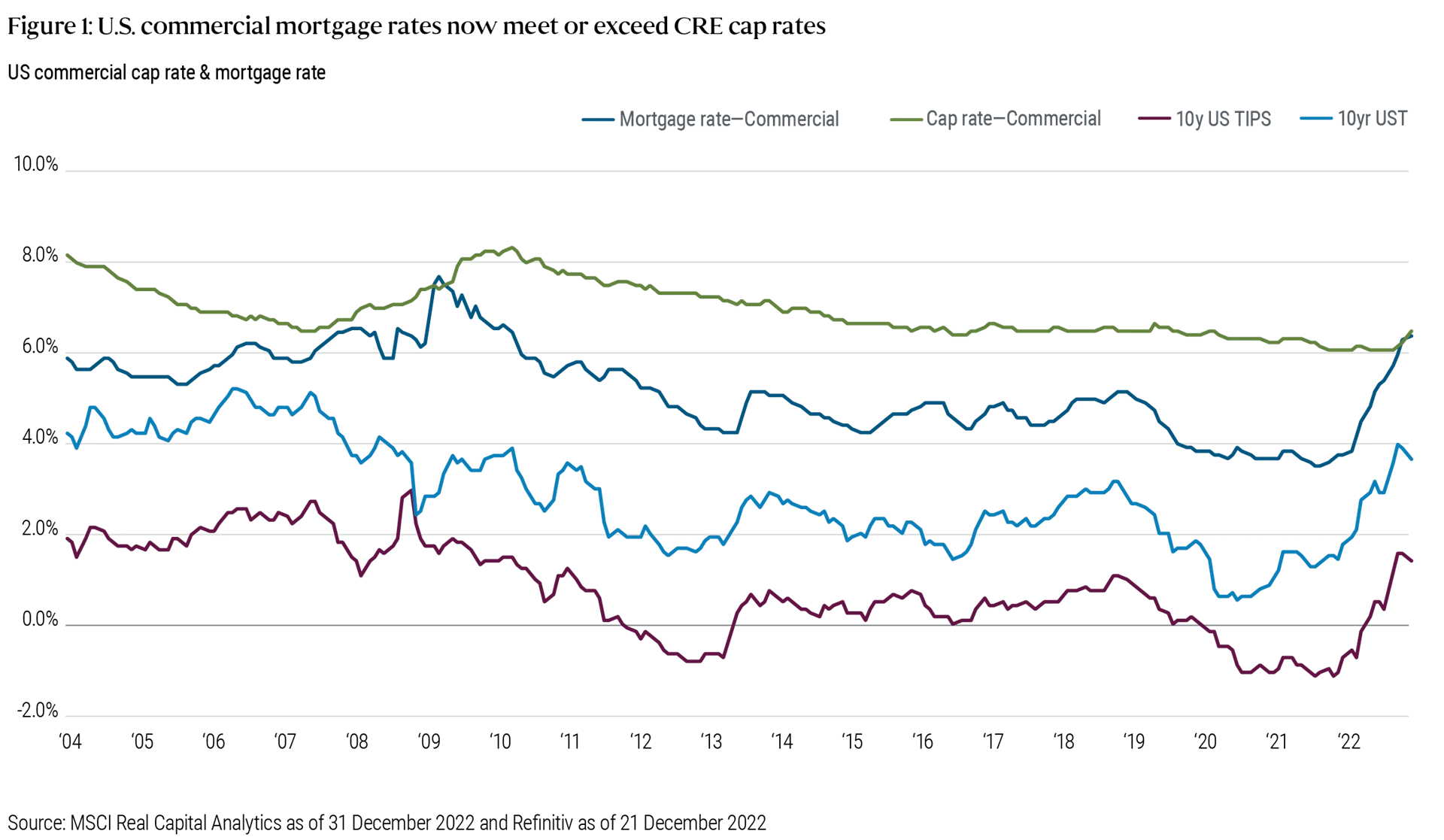

It’s a new world for the global commercial real estate (CRE) market. Amid sharply higher interest rates, debt costs have climbed above capitalization (cap) rates1 or net initial yields (see Figure 1), creating liquidity challenges for asset owners with floating-rate loans and those looking to sell or refinance. In response, real estate valuations are contracting and traditional avenues of financing, namely banks, CMBS originators, and mortgage REITs, have pulled back.

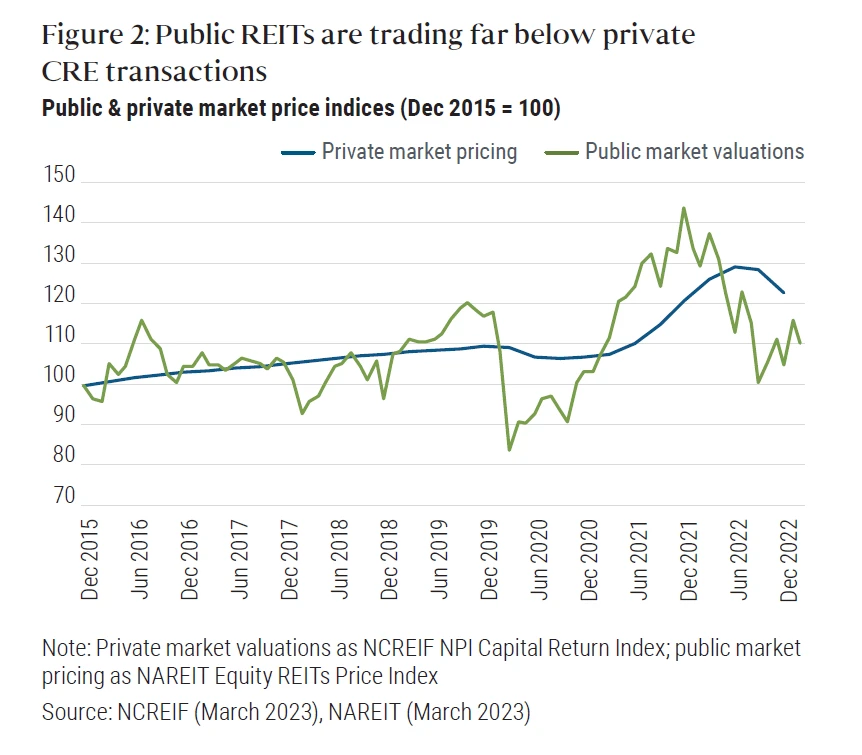

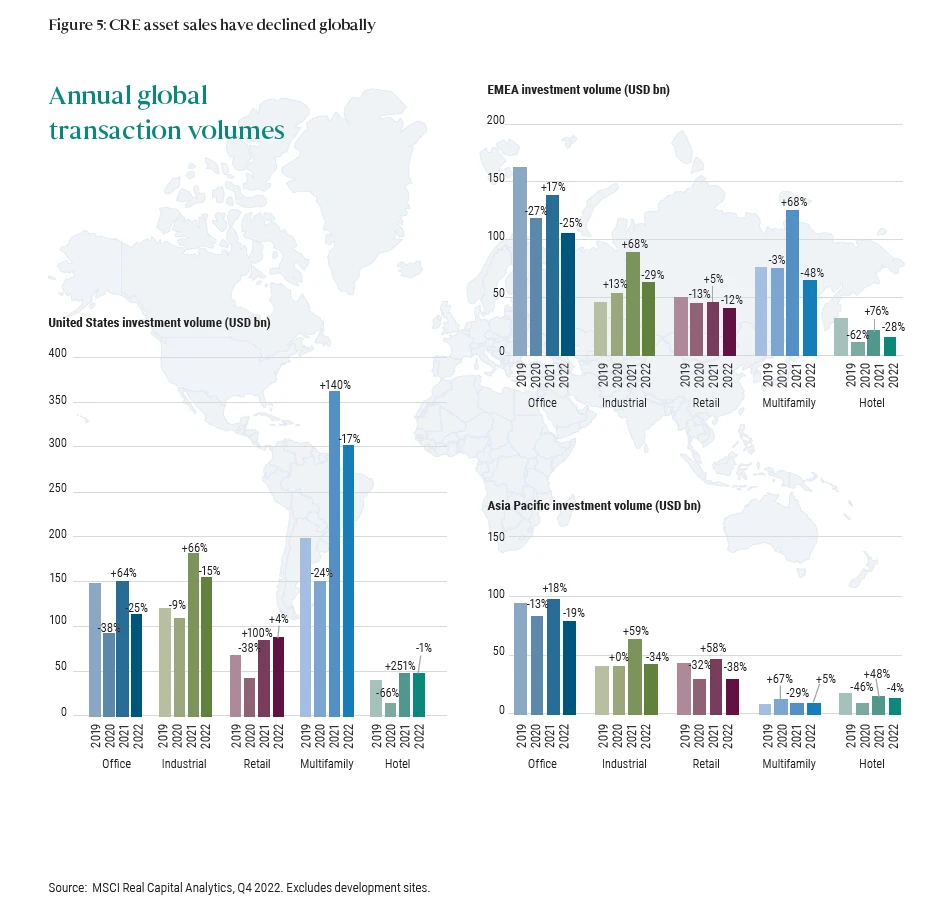

Private transaction volumes – or the total dollar amount of sales – fell sharply in the second half of 2022, ending the year down 22% year-over-year. With higher interest rates and few transactions, price discovery has become much more challenging across many private real estate assets. This has created a mismatch with prices in the public markets, which have plunged (see Figure 2). REITs are now trading at significant implied discounts to the appraised values of their assets and now imply materially higher cap rates than private markets are pricing in.

We expect asset sales, now stalled, to accelerate in 2023, driven by a combination of investor liquidity and balance sheet pressures, financing challenges, and those simply looking to sell ahead of potential further price declines. We see investment opportunities in this new real estate landscape, and anticipate more may arise as the landscape evolves.

Three key opportunities for investors in 2023

Debt

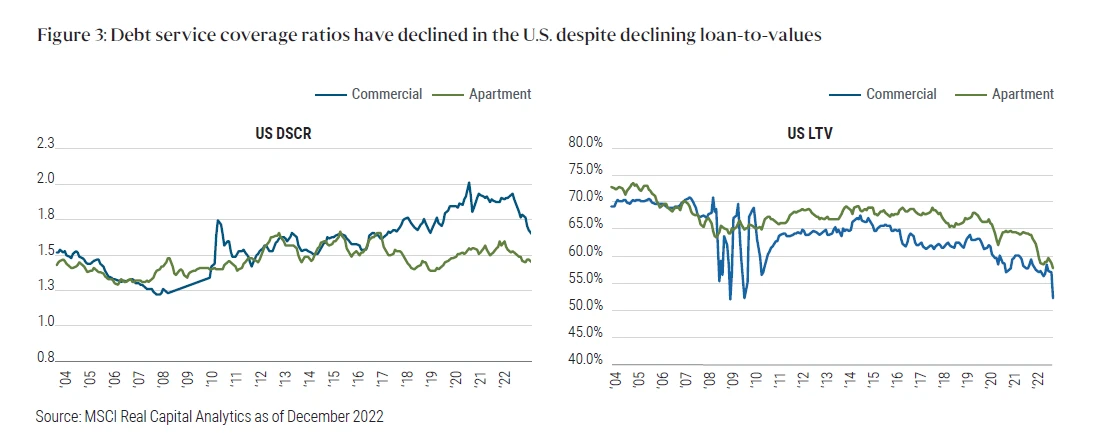

Rising borrowing costs and declining asset prices are pressuring real estate loans in the secondary market. Although in the U.S., loans as a percentage of asset values, known as loan-to-value ratios (LTVs), have declined for much of the last decade, the sharp rise in interest rates has strained borrowers’ capacity to service the debt. Indeed, shrinking debt service coverage ratios (DSCRs) are creating significant challenges for real estate lenders (see Figure 3).

Loan originations in the U.S. have fallen precipitously since May 2022, dropping 62% year-over-year in the five months through September 2022.2 In Europe, banks,3 which have provided about 95% of the €1.5 trillion in commercial real estate debt outstanding, are lending less on CRE assets (LTV), with particular weakness in core-plus financings, large loans, and commodity offices.

The bank pullback presents compelling opportunities for debt funds and other alternative lenders, which have fewer restrictions and are poised to benefit from higher all-in coupon rates. These include financings in senior LTV brackets where many bank lenders are currently too cautious or over-allocated. In addition, we see opportunities in making large loans. Banks are facing difficulties in syndicating and securitizing larger loans, bestowing a potential advantage to alternative lenders with adequate capacity and execution speed.

Special situations

CRE market distress set to accelerate, providing attractive investment opportunities

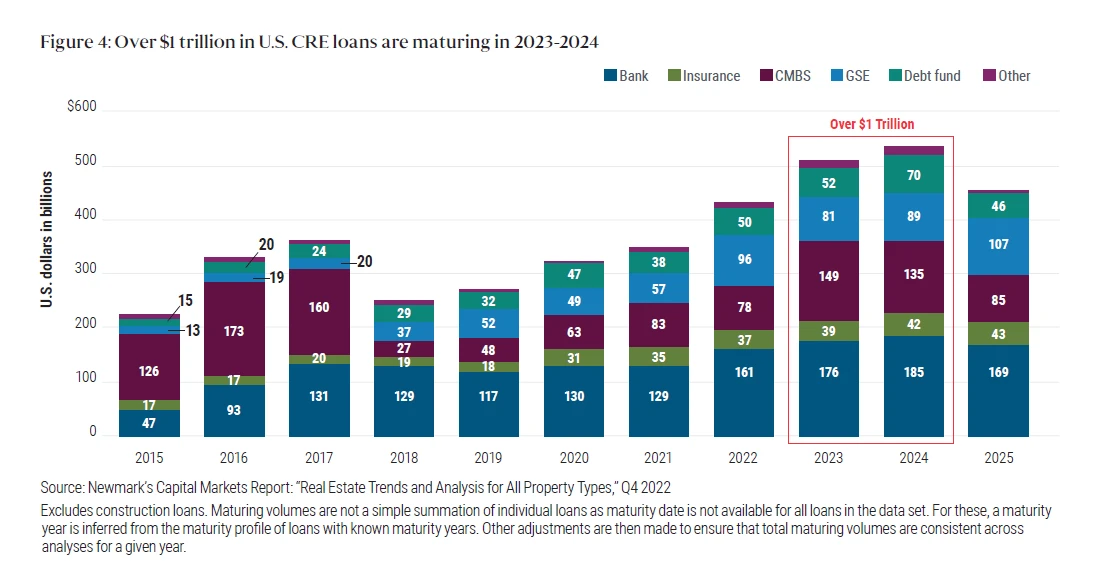

Approximately $2.4 trillion in U.S. commercial real estate loans are scheduled to mature between 2023 and 2027, more than $1 trillion of which is due this year and next (see Figure 4). U.S. office owners face a refinancing gap of around 20% of lending volume originated in 2018-2020, estimated to be over $50 billion.4

In addition to looming loan maturities, we expect investor redemptions from evergreen real estate funds and asset owners seeking to shore up balance sheets ahead of potential further economic weakness to drive further sales activity.

As traditional liquidity channels continue to dry up, we believe asset owners could turn to investors with the flexibility, experience, and creative structuring capabilities to offer bespoke capital solutions.

Alternative lenders can often offer capital solutions more quickly than traditional sources. In situations of distress, we see rescue capital in the form of junior debt or hybrid positions offering mid-teens and higher returns. These capital solutions could include high yield bridge capital for real estate owners to refinance an upcoming maturity or, in other cases, bespoke structured investments for private real estate lenders to manage their balance sheets. We expect this migration of opportunistic capital to focus on the middle of the capital structure – meaning that in the event of a liquidation, it would be paid after traditional senior bank debt, but before equity – which may provide opportunities for strong risk-adjusted returns.

Meanwhile, we are also seeing increasing demand for risk-transfer solutions from banks seeking to offload their exposure to sub- and non-performing real estate loans through the private market to satisfy increasingly stringent regulatory requirements. In Europe, this includes sub-performing or “stage two” loans, which currently are 9.5%, or €1.4 trillion, of all loans outstanding, of which commercial real estate is estimated to make up about 15%, or about €200 billion.Footnote5 Here, alternative lenders can capitalize on steep discounts by offering a variety of risk transfer solutions to financial institutions including loan purchases or more structured solutions.

Core

Core prime assets remain in demand by occupiers and investors

We believe the near standstill in private market transactions may subside with capital values adjusting during this period of price discovery, creating potential opportunities to acquire core assets at attractive levels (see Figure 5). With traditional lenders sidelined, this backdrop appears most compelling for unleveraged real estate buyers seeking high quality assets with a long-term investment horizon. We expect to find the most compelling opportunities in sectors with secular demand tailwinds, including logistics and multifamily.

On the supply side, developers are scaling back amid high construction and financing costs. Recent estimates for U.S. multifamily supply growth in 2025 have been cut to 1.4% annualized, down from 2.3% during 2023-2024.6 Declining supply should, in our view, support rents in the longer term.

In the short run, however, occupiers are putting expansion decisions on hold. Even the logistics and retail sectors feel the impact of weakening consumption as real disposable incomes fall. In the office sector, global leasing volumes fell by 19% year-over-year in 4Q 2022, but were up 9% for the full year after a strong first half 2022.7

One area we expect to see tenant demand continue is high quality offices in major markets, as tenants focus on upgrading their assets to establish a competitive hiring advantage. Employers look to these office assets not only to draw talented employees back to the workplace, but to enhance their net carbon zero credentials. Assets with high ESG (environmental, social and governance) ratings in excellent locations can command as much as an 11% rent premium and a 20% capital value premium8 over lower-quality second-grade assets. Both occupiers and investors are keen to access these assets.

Cross-border investors may be able to take advantage of recent currency depreciation in certain target markets. This applies in particular to cross-border investors with access to capital denominated in U.S. dollars, which appreciated by 8% in 2022 against a basket of other exchange rates.9

PIMCO’s global CRE reach and credit expertise seeks to provide a competitive advantage

PIMCO has one of the largest real estate platforms in the world, with a robust presence across the risk spectrum in global debt and equity markets. PIMCO’s global access to data and expertise support us in developing clear, secular macroeconomic themes, sourcing and structuring investment opportunities, and creating value through hands-on asset management. Given a relatively conservative risk posture in recent years, we believe the global PIMCO platform has a fundamental combination of deep resources and time tested investment experience to help identify opportunities in a real estate market facing acute liquidity pressures.

1 Capitalization rates, or cap rates, are calculated as the property’s net operating income divided by the current asset price. On an unleveraged property (i.e., with no debt), the cap rate represents the investor’s annual return.

2 Newmark, Capital Markets Report: “Real Estate Trends and Analysis for All Property Types,” Q3 2022.

3 European Banking Authority “Risk Assessment of the European Banking System”, December 2022

4 CBRE, The Office Sector Debt-Funding Gap, December 2022.

5 European Banking Authority “Risk Assessment of the European Banking System”, December 2022

6 Green Street, January/February 2023

7 Green Street, February 2023

8 JLL “Sustainability and Value”, January 2023

9 BIS, January 2023

Disclaimer

All investments contain risk and may lose value. Investments in residential/commercial mortgage loans and commercial real estate debt are subject to risks that include prepayment, delinquency, foreclosure, risks of loss, servicing risks and adverse regulatory developments, which risks may be heightened in the case of nonperforming loans. The value of real estate and portfolios that invest in real estate may fluctuate due to: losses from casualty or condemnation, changes in local and general economic conditions, supply and demand, interest rates, property tax rates, regulatory limitations on rents, zoning laws, and operating expenses. Investments in mortgage and asset-backed securities are highly complex instruments that may be sensitive to changes in interest rates and subject to early repayment risk. Structured products such as collateralized debt obligations are also highly complex instruments, typically involving a high degree of risk; use of these instruments may involve derivative instruments that could lose more than the principal amount invested. Private credit involves an investment in non-publicly traded securities which may be subject to illiquidity risk. Portfolios that invest in private credit may be leveraged and may engage in speculative investment practices that increase the risk of investment loss.

There can be no assurance that the trends mentioned will continue. Statements concerning financial market trends are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest long-term, especially during periods of downturn in the market.

This material contains the current opinions and views of the manager and such opinions are subject to change without notice. No representation is made or assurance given that such views are correct. This material is distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product in any jurisdiction. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. This is not an offer to any person in any jurisdiction where unlawful or unauthorized. | Pacific Investment Management Company LLC (650 Newport Center Drive, Newport Beach, CA 92660) is regulated by the United States Securities and Exchange Commission. | PIMCO Europe Ltd (Company No. 2604517, 11 Baker Street, London W1U 3AH, United Kingdom) is authorised and regulated by the Financial Conduct Authority (FCA) (12 Endeavour Square, London E20 1JN) in the UK. The services provided by PIMCO Europe Ltd are not available to retail investors, who should not rely on this communication but contact their financial adviser. Since PIMCO Europe Ltd services and products are provided exclusively to professional clients, the appropriateness of such is always affirmed. | PIMCO Europe GmbH (Company No. 192083, Seidlstr. 24-24a, 80335 Munich, Germany), PIMCO Europe GmbH Italian Branch (Company No. 10005170963, via Turati nn. 25/27 (angolo via Cavalieri n. 4), 20121 Milano, Italy), PIMCO Europe GmbH Irish Branch (Company No. 909462, 57B Harcourt Street Dublin D02 F721, Ireland), PIMCO Europe GmbH UK Branch (Company No. FC037712, 11 Baker Street, London W1U 3AH, UK), PIMCO Europe GmbH Spanish Branch (N.I.F. W2765338E, Paseo de la Castellana 43, Oficina 05-111, 28046 Madrid, Spain) and PIMCO Europe GmbH French Branch (Company No. 918745621 R.C.S. Paris, 50–52 Boulevard Haussmann, 75009 Paris, France) are authorised and regulated by the German Federal Financial Supervisory Authority (BaFin) (Marie- Curie-Str. 24-28, 60439 Frankfurt am Main) in Germany in accordance with Section 15 of the German Securities Institutions Act (WpIG). The Italian Branch, Irish Branch, UK Branch, Spanish Branch and French Branch are additionally supervised by: (1) Italian Branch: the Commissione Nazionale per le Società e la Borsa (CONSOB) (Giovanni Battista Martini, 3 - 00198 Rome) in accordance with Article 27 of the Italian Consolidated Financial Act; (2) Irish Branch: the Central Bank of Ireland (New Wapping Street, North Wall Quay, Dublin 1 D01 F7X3) in accordance with Regulation 43 of the European Union (Markets in Financial Instruments) Regulations 2017, as amended; (3) UK Branch: the Financial Conduct Authority (FCA) (12 Endeavour Square, London E20 1JN); (4) Spanish Branch: the Comisión Nacional del Mercado de Valores (CNMV) (Edison, 4, 28006 Madrid) in accordance with obligations stipulated in articles 168 and 203 to 224, as well as obligations contained in Tile V, Section I of the Law on the Securities Market (LSM) and in articles 111, 114 and 117 of Royal Decree 217/2008, respectively and (5) French Branch: ACPR/Banque de France (4 Place de Budapest, CS 92459, 75436 Paris Cedex 09) in accordance with Art. 35 of Directive 2014/65/EU on markets in financial instruments and under the surveillance of ACPR and AMF. The services provided by PIMCO Europe GmbH are available only to professional clients as defined in Section 67 para. 2 German Securities Trading Act (WpHG). They are not available to individual investors, who should not rely on this communication. According to Art. 56 of Regulation (EU) 565/2017, an investment company is entitled to assume that professional clients possess the necessary knowledge and experience to understand the risks associated with the relevant investment services or transactions. Since PIMCO Europe GMBH services and products are provided exclusively to professional clients, the appropriateness of such is always affirmed. | PIMCO (Schweiz) GmbH (registered in Switzerland, Company No. CH-020.4.038.582-2, Brandschenkestrasse 41 Zurich 8002, Switzerland). According to the Swiss Collective Investment Schemes Act of 23 June 2006 (“CISA”), an investment company is entitled to assume that professional clients possess the necessary knowledge and experience to understand the risks associated with the relevant investment services or transactions. Since PIMCO (Schweiz) GmbH services and products are provided exclusively to professional clients, the appropriateness of such is always affirmed. The services provided by PIMCO (Schweiz) GmbH are not available to retail investors, who should not rely on this communication but contact their financial adviser. | PIMCO Asia Pte Ltd (8 Marina View, #30-01, Asia Square Tower 1, Singapore 018960, Registration No. 199804652K) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence and an exempt financial adviser. The asset management services and investment products are not available to persons where provision of such services and products is unauthorised. | PIMCO Asia Limited (Suite 2201, 22nd Floor, Two International Finance Centre, No. 8 Finance Street, Central, Hong Kong) is licensed by the Securities and Futures Commission for Types 1, 4 and 9 regulated activities under the Securities and Futures Ordinance. PIMCO Asia Limited is registered as a cross-border discretionary investment manager with the Financial Supervisory Commission of Korea (Registration No. 08-02-307). The asset management services and investment products are not available to persons where provision of such services and products is unauthorised. | PIMCO Investment Management (Shanghai) Limited. Office address: Suite 7204, Shanghai Tower, 479 Lujiazui Ring Road, Pudong, Shanghai 200120, China (Unified social credit code: 91310115MA1K41MU72) is registered with Asset Management Association of China as Private Fund Manager (Registration No. P1071502, Type: Other). | PIMCO Australia Pty Ltd ABN 54 084 280 508, AFSL 246862. This publication has been prepared without taking into account the objectives, financial situation or needs of investors. Before making an investment decision, investors should obtain professional advice and consider whether the information contained herein is appropriate having regard to their objectives, financial situation and needs. To the extent it involves Pacific Investment Management Co LLC (PIMCO LLC) providing financial services to wholesale clients, PIMCO LLC is exempt from the requirement to hold an Australian financial services licence in respect of financial services provided to wholesale clients in Australia. PIMCO LLC is regulated by the Securities and Exchange Commission under US laws, which differ from Australian laws. | PIMCO Japan Ltd, Financial Instruments Business Registration Number is Director of Kanto Local Finance Bureau (Financial Instruments Firm) No. 382. PIMCO Japan Ltd is a member of Japan Investment Advisers Association, The Investment Trusts Association, Japan and Type II Financial Instruments Firms Association. All investments contain risk. There is no guarantee that the principal amount of the investment will be preserved, or that a certain return will be realized; the investment could suffer a loss. All profits and losses incur to the investor. The amounts, maximum amounts and calculation methodologies of each type of fee and expense and their total amounts will vary depending on the investment strategy, the status of investment performance, period of management and outstanding balance of assets and thus such fees and expenses cannot be set forth herein. | PIMCO Taiwan Limited is an independently operated and managed company. The reference number of business license of the company approved by the competent authority is (112) Jin Guan Tou Gu Xin Zi No. 015 . The registered address of the company is 40F., No.68, Sec. 5, Zhongxiao East Rd., Xinyi District, Taipei City 110, Taiwan (R.O.C.), and the telephone number is +886 2 8729-5500. | PIMCO Canada Corp. (199 Bay Street, Suite 2050, Commerce Court Station, P.O. Box 363, Toronto, ON, M5L 1G2) services and products may only be available in certain provinces or territories of Canada and only through dealers authorized for that purpose. | Note to Readers in Colombia: This document is provided through the representative office of Pacific Investment Management Company LLC located at Carrera 7 No. 71-52 TB Piso 9, Bogota D.C. (Promoción y oferta de los negocios y servicios del mercado de valores por parte de Pacific Investment Management Company LLC, representada en Colombia.). Note to Readers in Brazil: PIMCO Latin America Administradora de Carteiras Ltda.Av. Brg. Faria Lima, 3477 Itaim Bibi, São Paulo - SP 04538-132 Brazil. Note to Readers in Argentina: This document may be provided through the representative office of PIMCO Global Advisors LLC AVENIDA CORRIENTES, 299, Buenos Aires, Argentina. | No part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. ©2024, PIMCO.

PIMCO Prime Real Estate is a PIMCO company. PIMCO Prime Real Estate LLC is a wholly-owned subsidiary of PIMCO LLC, and PIMCO Prime Real Estate GmbH and its affiliates are wholly-owned by PIMCO Europe GmbH. PIMCO Prime Real Estate GmbH operates separately from PIMCO. PIMCO Prime Real Estate is a trademark of PIMCO LLC and PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world.