Sectors

Our ability to identify real estate opportunities and execute strategies across sectors and in different markets throughout the world offers huge value to investors.

Our in-house teams of real estate professionals have proven capabilities in deal-sourcing, asset management and building development and have established a deep network of global operating partners.

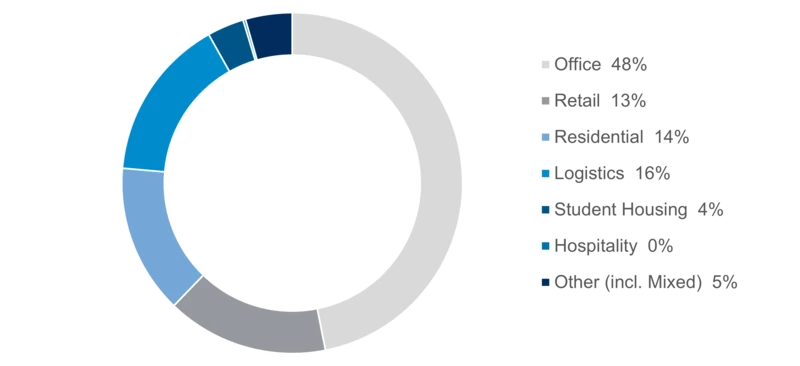

Equity and debt portfolio composition by sector, 30st September 2025

"Today’s prime office users demand an ever-increasing focus on their well-being. Investments in this sector, either as acquisitions or redevelopments, must therefore be characterized by flexible, sustainably operated buildings within primary, high-density cities, and which offer the smart, digital services that enable tenants to attract and retain talent."

Nicole Pötsch, Head of North & Central Europe

LOGISTICS

"The fundamentals driving global logistics – e-commerce growth, sustainable facilities, near-shoring – continue to underline the sector’s attractiveness. Our in-house expertise is complemented by a vast network of partners granting us ‘first sight’ on major asset and portfolio deals."

Donato Saponara, Head of South & West Europe

STUDENT HOUSING

“The growing education sector is an under-supplied market combined with strong international mobility and demand. Our global portfolio consists of stabilized core assets that leverage our global platform, scale, and select build-to-core activity with a focus on the UK, the U.S. and Australia.”

Danny Phuan, Head of Acquisitions, Asia Pacific & Head of China

RESIDENTIAL

"We have managed residential assets for many decades, particularly in the U.S. and Europe, more recently in Asia-Pacific. This sector is heavily influenced by local nuances, but the global trends around urbanization and lifestyle changes affect all regions and are creating new opportunities in real estate’s most resilient sector."

Adam Lerer, Director of Acquisitions, U.S.