Facing the Music: Challenges and Opportunities in Today’s Commercial Real Estate Market

BY JOHN MURRAY, FRANÇOIS TRAUSCH

Summary

- The headwinds buffeting the commercial real estate market will likely result in a materially slower recovery than that seen after the global financial crisis.

- Nonetheless, the market is entering a phase with numerous opportunities for those with capital, patience, agility, and expertise to provide financing solutions to both lenders and borrowers.

- From a sector perspective, we believe investors should focus on high conviction themes, including digitalization, decarbonization, and demographic shifts, targeting sectors such as data centers and logistics.

For commercial real estate (CRE) borrowers and lenders, central banks have been a persistent source of frustration in recent years. Aiming to rein in stubborn inflation, the Federal Reserve and most of its peers have maintained elevated interest rates longer than anticipated. That’s their mandate, of course. But the consequences have been immediate pain for CRE borrowers facing higher debt costs, along with a duller discomfort from falling valuations due to reduced liquidity and higher capitalization rates.

Today, short-term interest rates appear to have peaked, and long-term interest rates are slowly trending lower. One might – but should not – see these trends as leading to a dramatic recovery of the sort induced by quantitative easing in the aftermath of the global financial crisis. Prevailing market assumptions, with a forward curve indicating real rates 200–300 basis points (bps) above 2021 levels, suggest that cap rates will remain elevated, keeping property values 20%–40% below their 2021 highs.

As a $1.5 trillion wall of loan maturities hits over the next two years,1 the implications are profound. In an elevated interest rate environment, borrowing costs and cap rates will remain challenging. Lenders and borrowers will be forced to “face the music”: In the near term, we expect further declines in appraised valuations and price indices, making loan extensions even more difficult to rationalize.

There’s also geopolitical risk. Conflicts in Ukraine and the Middle East, tensions between the U.S. and China, and major elections this year give rise to additional uncertainty. This is compounded by growing concerns over climate change that directly affect real estate investment and development.

While these uncertainties will prolong liquidity pressures, they also create opportunities across the financing spectrum. For those with capital and proficiency in customized solutions, private opportunities range from senior debt to mezzanine debt and preferred equity. Continued volatility may also create relative value opportunities across the four quadrants of real estate investment: public and private equity, and public and private debt. Additionally, some sectors and geographies remain attractive based on long-term fundamentals, implying an attractive entry point today given the liquidity pressures facing CRE broadly (see Figure 1).

Figure 1: Global real estate heat map - 2024 vs. 2023 outlook by sector and region

Source: PIMCO Global Real Estate Forums 2023 and 2024

These takeaways were gathered from PIMCO’s second annual Global Real Estate Investment Forum, held in May. Similar to PIMCO’s Cyclical and Secular Forums, this event convened global investment professionals to discuss the near- and long-term outlook for commercial real estate. PIMCO has one of the world’s largest CRE platforms, with over 300 investment professionals managing close to $190 billion in assets across a broad spectrum of risk profiles in public and private global real estate debt and equity markets.2

Key sectors

DATA CENTERS: A RACE FOR POWER IN THE AGE OF AI

The AI boom has set off a global dash for data centers and green energy to power them, and it also has introduced broad risks to CRE. Over the long term, AI could reduce the need for office space, decrease demand for student housing, lower urban population density, and make long-term leases and secondary locations less attractive. However, the pace and scale of repercussions remain unclear. (See our June 2024 article, “Powering the Future: The Strategic Role of Data Centres in the AI Evolution in Europe”.)

What is clear is that demand for AI and cloud services has ignited a global scramble for data center capacity. In the first quarter of 2024, global leasing volumes surpassed 1,800 megawatts, a sevenfold increase from just three years ago.3 Growth shows no signs of slowing, with tenants contracting for entire campuses rather than individual buildings. This is amplified by governments’ quest for digital sovereignty – the ability to control critical data, software, and hardware. Conversely, limited supplies of power are becoming a growing constraint on data center development across the globe.

Data centers will play a pivotal role in investor portfolios in the coming years. They are critical infrastructure, offering investors a way to capitalize on AI growth as suppliers to AI platforms without having to bet on the ultimate winners in AI technology.

LOGISTICS AND WAREHOUSES: SECULAR DEMAND SUSTAINS LONG-TERM GROWTH

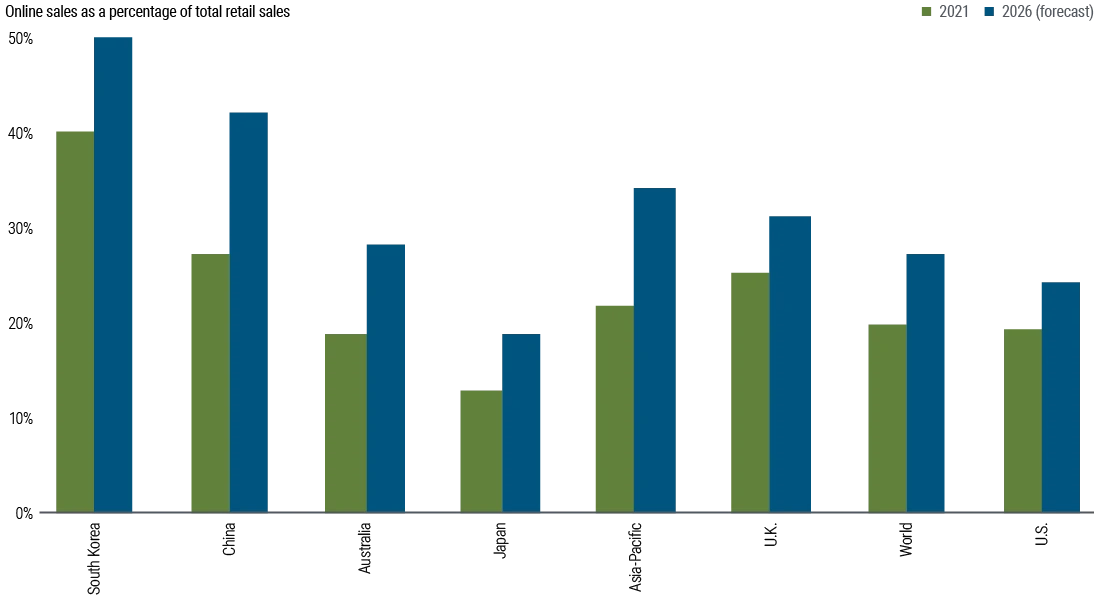

We anticipate that deglobalization and e-commerce will continue to drive sustained long-term growth in warehouses and logistics. Though geopolitics will influence demand, logistics facilities linked to digitalization trends, such as e-commerce, appear to have a more reliable demand trajectory (see Figure 2).

Figure 2: Online commerce continues to grow

Source: PIMCO as of June 2023

In Europe, demand is slowing but rents continue to increase. Logistics, once again, tops many investors’ shopping lists, and may provide a floor to today’s widened capitalization rates.

In the Asia-Pacific region, online sales are projected to grow from about 20% of total sales in 2021 to nearly 40% by 2026.4 Further, deglobalization continues to drive nearshoring and “friendshoring” trends. Vietnam and India will gain as companies shift production from China, while reshoring could benefit Japan and South Korea.

In the U.S., industrial demand remains positive, although net absorption has slowed over the last six months, with the first quarter of 2024 being the weakest first quarter since 2012.5 New deliveries have peaked, although some lower-barrier Sun Belt markets are digesting a supply wave that could lead to a prolonged period of higher availability, particularly among larger industrial properties; in recent years, developers have focused on projects over 100,000 square feet.

MULTIFAMILY HOUSING: STRONG DEMAND, BUT RECOVERY DELAYED IN THE U.S.

The global outlook for apartment buildings is generally positive amid strong structural demand.

In Europe, rents are rising steadily with no signs of abating. Limited supply, exacerbated by high development costs and stricter environmental regulations, is meeting firming demand as household formation accelerates and migration to major metropolitan regions continues.

In the Asia-Pacific region, prices and rents are firming amid moderate undersupply. Soaring home prices and urban migration by younger individuals are driving demand. Demographic shifts, such as delayed family formation and the rise of single-person households, are reinforcing the trend of renting for longer periods. In addition, the evolving emphasis on community living and access to amenities has boosted the growth of thematic residential and co-living spaces across the region.

In the U.S., the near-term outlook is slightly less positive. The multifamily sector overall is experiencing record new supply, with apartment completions reaching a 40-year high of 583,000 units last year.6 This surge has led to rising vacancies and, coupled with widening cap rates, has resulted in market values dropping by more than 25%–30%. While long-term tenant demand fundamentals remain strong for multifamily – particularly as higher rates exacerbate already challenged affordability metrics – these short-term pressures suggest more distress in the near term for the U.S. multifamily sector.

Overall, the U.S. market is likely to stabilize by 2026. Construction starts have fallen due to higher costs and tighter financing. The Sun Belt, spanning the southern tier of U.S. states, shines as a key area of growth. The region is home to half of the country’s population, and its incoming domestic and international migration is projected to drive the vast majority of the increase in the U.S. population from 335 million today to 373 million by 2054.7

OFFICES: FACING HEADWINDS, BUT NOT EVERYWHERE

The global outlook for offices remains challenging. Demand and price discovery are limited worldwide, with valuations still under pressure as global CRE owners and lenders look to reduce office allocations. The share of offices in global institutional CRE portfolios has fallen from 35% in 2022 to 29% today,8 with further declines likely.

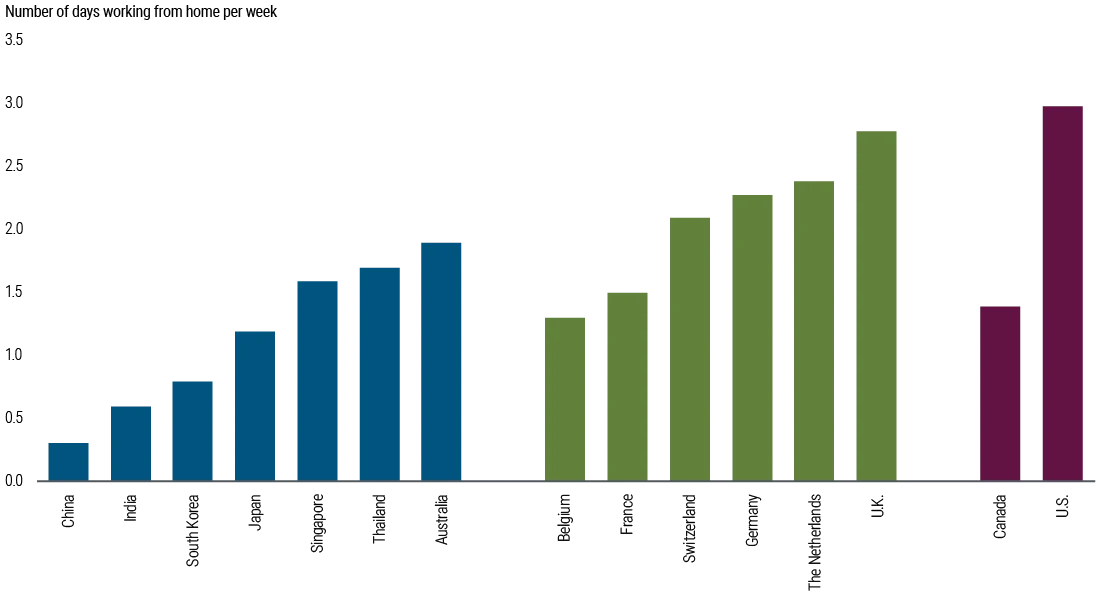

However, regional outlooks vary. In Europe, there is relatively healthy demand for green, high quality buildings in prime central business districts. The work-from-home trend is less entrenched in many parts of Europe, partly because workers tend to live in smaller homes in city centers and have better public transportation. Tenants tend to be stickier because of the Continent’s linguistic, currency, and regulatory diversity, which complicates corporate relocations. Importantly, energy regulations will likely dramatically reduce existing supply, as many office buildings will struggle to meet increasingly stringent rating requirements in Europe.

In the Asia-Pacific region, demand for offices in central business districts remains broadly near 2021 levels. This is due to generally smaller apartments, shorter commutes, and a more persistent ”work-at-the-office” culture than in the West. As in Europe, demand is strongest in central business districts, especially for buildings with “live, work, play” amenities (see Figure 3). In the U.S., corporate cost-cutting and a stronger work-from-home trend have led to office demand lagging behind job creation. Here, we expect prices and rents outside of class A+ buildings to continue falling as private capital remains cautious and headline cap rates continue to expand.

Figure 3: The U.S. leads in working from home

TAKEAWAYS: SEIZING OPPORTUNITIES AMID CHALLENGES

The commercial real estate market stands at a crossroads, beset by formidable challenges yet brimming with opportunities. Elevated interest rates, geopolitical tensions, and climate change concerns have created a complex and often dismaying landscape for CRE borrowers and lenders.

Yet these very pressures also set the stage for innovative financing solutions and strategic investments. For those equipped with capital and expertise, today’s environment offers fertile ground for opportunities across the financing spectrum, from senior debt to mezzanine debt and preferred equity. Sectors such as data centers and logistics, buoyed by enduring trends in digitalization and e-commerce, present particularly enticing prospects.

Navigating this turbulent terrain will require resilience and adaptability. The ability to discern and exploit hidden opportunities amid market volatility will be essential. By homing in on high conviction themes such as digitalization, decarbonization, and demographic shifts, and leveraging PIMCO’s extensive expertise and global platform, investors have the potential to not only weather the current storm but also thrive in the evolving commercial real estate landscape. The road ahead is fraught with uncertainties, but it is also rich with potential for those ready to face the music and seize the moment.

1 Source: CBRE as of May 2024

2 Source: PIMCO as of 31 March 2024. Includes assets managed by Prime Real Estate (formerly Allianz Real Estate), an affiliate and wholly owned subsidiary of PIMCO and PIMCO Europe GmbH, that includes PIMCO Prime Real Estate GmbH, PIMCO Prime Real Estate LLC and their subsidiaries and affiliates. PIMCO Prime Real Estate LLC investment professionals provide investment management and other services as dual personnel through Pacific Investment Management Company LLC. PIMCO Prime Real Estate GmbH operates separately from PIMCO.

3 Source: datacenterHawk as of 31 March 2024

4 Source: Green Street and CBRE as of April 2024

5 Source: Green Street as of April 2024

6 Source: CoStar as of 17 March 2024

7 Source: U.S. Congressional Budget Office

8 Source: Pension Real Estate Association Investment Intentions Survey, 2022 and 2024

Disclaimer

All investments contain risk and may lose value. Investments in residential/commercial mortgage loans and commercial real estate debt are subject to risks that include prepayment, delinquency, foreclosure, risks of loss, servicing risks and adverse regulatory developments, which risks may be heightened in the case of nonperforming loans. The value of real estate and portfolios that invest in real estate may fluctuate due to: losses from casualty or condemnation, changes in local and general economic conditions, supply and demand, interest rates, property tax rates, regulatory limitations on rents, zoning laws, and operating expenses. Investments in mortgage and asset-backed securities are highly complex instruments that may be sensitive to changes in interest rates and subject to early repayment risk. Structured products such as collateralized debt obligations are also highly complex instruments, typically involving a high degree of risk; use of these instruments may involve derivative instruments that could lose more than the principal amount invested. Private credit involves an investment in non-publicly traded securities which may be subject to illiquidity risk. Portfolios that invest in private credit may be leveraged and may engage in speculative investment practices that increase the risk of investment loss.

There can be no assurance that the trends mentioned will continue. Statements concerning financial market trends are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest long-term, especially during periods of downturn in the market.

This material contains the current opinions and views of the manager and such opinions are subject to change without notice. No representation is made or assurance given that such views are correct. This material is distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product in any jurisdiction. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. This is not an offer to any person in any jurisdiction where unlawful or unauthorized. | Pacific Investment Management Company LLC (650 Newport Center Drive, Newport Beach, CA 92660) is regulated by the United States Securities and Exchange Commission. | PIMCO Europe Ltd (Company No. 2604517, 11 Baker Street, London W1U 3AH, United Kingdom) is authorised and regulated by the Financial Conduct Authority (FCA) (12 Endeavour Square, London E20 1JN) in the UK. The services provided by PIMCO Europe Ltd are not available to retail investors, who should not rely on this communication but contact their financial adviser. Since PIMCO Europe Ltd services and products are provided exclusively to professional clients, the appropriateness of such is always affirmed. | PIMCO Europe GmbH (Company No. 192083, Seidlstr. 24-24a, 80335 Munich, Germany), PIMCO Europe GmbH Italian Branch (Company No. 10005170963, via Turati nn. 25/27 (angolo via Cavalieri n. 4), 20121 Milano, Italy), PIMCO Europe GmbH Irish Branch (Company No. 909462, 57B Harcourt Street Dublin D02 F721, Ireland), PIMCO Europe GmbH UK Branch (Company No. FC037712, 11 Baker Street, London W1U 3AH, UK), PIMCO Europe GmbH Spanish Branch (N.I.F. W2765338E, Paseo de la Castellana 43, Oficina 05-111, 28046 Madrid, Spain) and PIMCO Europe GmbH French Branch (Company No. 918745621 R.C.S. Paris, 50–52 Boulevard Haussmann, 75009 Paris, France) are authorised and regulated by the German Federal Financial Supervisory Authority (BaFin) (Marie- Curie-Str. 24-28, 60439 Frankfurt am Main) in Germany in accordance with Section 15 of the German Securities Institutions Act (WpIG). The Italian Branch, Irish Branch, UK Branch, Spanish Branch and French Branch are additionally supervised by: (1) Italian Branch: the Commissione Nazionale per le Società e la Borsa (CONSOB) (Giovanni Battista Martini, 3 - 00198 Rome) in accordance with Article 27 of the Italian Consolidated Financial Act; (2) Irish Branch: the Central Bank of Ireland (New Wapping Street, North Wall Quay, Dublin 1 D01 F7X3) in accordance with Regulation 43 of the European Union (Markets in Financial Instruments) Regulations 2017, as amended; (3) UK Branch: the Financial Conduct Authority (FCA) (12 Endeavour Square, London E20 1JN); (4) Spanish Branch: the Comisión Nacional del Mercado de Valores (CNMV) (Edison, 4, 28006 Madrid) in accordance with obligations stipulated in articles 168 and 203 to 224, as well as obligations contained in Tile V, Section I of the Law on the Securities Market (LSM) and in articles 111, 114 and 117 of Royal Decree 217/2008, respectively and (5) French Branch: ACPR/Banque de France (4 Place de Budapest, CS 92459, 75436 Paris Cedex 09) in accordance with Art. 35 of Directive 2014/65/EU on markets in financial instruments and under the surveillance of ACPR and AMF. The services provided by PIMCO Europe GmbH are available only to professional clients as defined in Section 67 para. 2 German Securities Trading Act (WpHG). They are not available to individual investors, who should not rely on this communication. According to Art. 56 of Regulation (EU) 565/2017, an investment company is entitled to assume that professional clients possess the necessary knowledge and experience to understand the risks associated with the relevant investment services or transactions. Since PIMCO Europe GMBH services and products are provided exclusively to professional clients, the appropriateness of such is always affirmed. | PIMCO (Schweiz) GmbH (registered in Switzerland, Company No. CH-020.4.038.582-2, Brandschenkestrasse 41 Zurich 8002, Switzerland). According to the Swiss Collective Investment Schemes Act of 23 June 2006 (“CISA”), an investment company is entitled to assume that professional clients possess the necessary knowledge and experience to understand the risks associated with the relevant investment services or transactions. Since PIMCO (Schweiz) GmbH services and products are provided exclusively to professional clients, the appropriateness of such is always affirmed. The services provided by PIMCO (Schweiz) GmbH are not available to retail investors, who should not rely on this communication but contact their financial adviser. | PIMCO Asia Pte Ltd (8 Marina View, #30-01, Asia Square Tower 1, Singapore 018960, Registration No. 199804652K) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence and an exempt financial adviser. The asset management services and investment products are not available to persons where provision of such services and products is unauthorised. | PIMCO Asia Limited (Suite 2201, 22nd Floor, Two International Finance Centre, No. 8 Finance Street, Central, Hong Kong) is licensed by the Securities and Futures Commission for Types 1, 4 and 9 regulated activities under the Securities and Futures Ordinance. PIMCO Asia Limited is registered as a cross-border discretionary investment manager with the Financial Supervisory Commission of Korea (Registration No. 08-02-307). The asset management services and investment products are not available to persons where provision of such services and products is unauthorised. | PIMCO Investment Management (Shanghai) Limited. Office address: Suite 7204, Shanghai Tower, 479 Lujiazui Ring Road, Pudong, Shanghai 200120, China (Unified social credit code: 91310115MA1K41MU72) is registered with Asset Management Association of China as Private Fund Manager (Registration No. P1071502, Type: Other). | PIMCO Australia Pty Ltd ABN 54 084 280 508, AFSL 246862. This publication has been prepared without taking into account the objectives, financial situation or needs of investors. Before making an investment decision, investors should obtain professional advice and consider whether the information contained herein is appropriate having regard to their objectives, financial situation and needs. To the extent it involves Pacific Investment Management Co LLC (PIMCO LLC) providing financial services to wholesale clients, PIMCO LLC is exempt from the requirement to hold an Australian financial services licence in respect of financial services provided to wholesale clients in Australia. PIMCO LLC is regulated by the Securities and Exchange Commission under US laws, which differ from Australian laws. | PIMCO Japan Ltd, Financial Instruments Business Registration Number is Director of Kanto Local Finance Bureau (Financial Instruments Firm) No. 382. PIMCO Japan Ltd is a member of Japan Investment Advisers Association, The Investment Trusts Association, Japan and Type II Financial Instruments Firms Association. All investments contain risk. There is no guarantee that the principal amount of the investment will be preserved, or that a certain return will be realized; the investment could suffer a loss. All profits and losses incur to the investor. The amounts, maximum amounts and calculation methodologies of each type of fee and expense and their total amounts will vary depending on the investment strategy, the status of investment performance, period of management and outstanding balance of assets and thus such fees and expenses cannot be set forth herein. | PIMCO Taiwan Limited is an independently operated and managed company. The reference number of business license of the company approved by the competent authority is (112) Jin Guan Tou Gu Xin Zi No. 015 . The registered address of the company is 40F., No.68, Sec. 5, Zhongxiao East Rd., Xinyi District, Taipei City 110, Taiwan (R.O.C.), and the telephone number is +886 2 8729-5500. | PIMCO Canada Corp. (199 Bay Street, Suite 2050, Commerce Court Station, P.O. Box 363, Toronto, ON, M5L 1G2) services and products may only be available in certain provinces or territories of Canada and only through dealers authorized for that purpose. | Note to Readers in Colombia: This document is provided through the representative office of Pacific Investment Management Company LLC located at Carrera 7 No. 71-52 TB Piso 9, Bogota D.C. (Promoción y oferta de los negocios y servicios del mercado de valores por parte de Pacific Investment Management Company LLC, representada en Colombia.). Note to Readers in Brazil: PIMCO Latin America Administradora de Carteiras Ltda.Av. Brg. Faria Lima, 3477 Itaim Bibi, São Paulo - SP 04538-132 Brazil. Note to Readers in Argentina: This document may be provided through the representative office of PIMCO Global Advisors LLC AVENIDA CORRIENTES, 299, Buenos Aires, Argentina. | No part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. ©2024, PIMCO.

PIMCO Prime Real Estate is a PIMCO company. PIMCO Prime Real Estate LLC is a wholly-owned subsidiary of PIMCO LLC, and PIMCO Prime Real Estate GmbH and its affiliates are wholly-owned by PIMCO Europe GmbH. PIMCO Prime Real Estate GmbH operates separately from PIMCO. PIMCO Prime Real Estate is a trademark of PIMCO LLC and PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world.